As active venture capital investors, we regularly participate in unpriced rounds, often through SAFEs. The SAFE, which is shorthand for Simple Agreement for Forward Equity was popularized by Y Combinator back in 2013 and has become a very popular method for raising financing without too much to-and-fro on trying to establish a valuation for the company.

SAFEs are short five-page documents, with only two negotiable elements: the valuation cap and the discount. The idea is to allow startups to structure seed investments without interest rates or maturity dates.This simple, widely circulated, standardised legal document is supposed to save early stage companies and their investors time and money without needing to engage (expensive) lawyers.

Over the last few years, more and more fund-raises gone wrong have been highlighting how SAFEs are in fact, quite unsafe. This great article from Tech Crunch highlighted that SAFEs have some short-comings for entrepreneurs that may not be immediately obvious. Now that early-stage fundraising is experiencing record volumes of deals, and along with it, record valuations, we are experiencing the pain of these unsafe SAFEs first hand.

The Gordian Knot: Seven years of SAFEs

One company I looked recently at had issued a total of nine SAFEs or convertible notes over a period of seven years, each with different terms for Qualified Eligible Financing, Valuation Cap & Discount etc. Although some of these had already converted by the time I was working with them, there were still five outstanding notes due to convert at Series A. Modeling the dilution was like running some crazy refinery linear program, and the end result was a nasty surprise to everyone involved.

And that’s the trouble, really.

The skill you’re investing in when you put your money with a tech entrepreneur is not financial engineering.

So the danger is that your team find themselves encumbered by a Gordian Knot of share classes, SAFEs and convertible notes that can make it extremely difficult to raise a priced round and leave the team with a meaningful stake, especially if the business has progressed slower than hoped.

Imagine the following case.

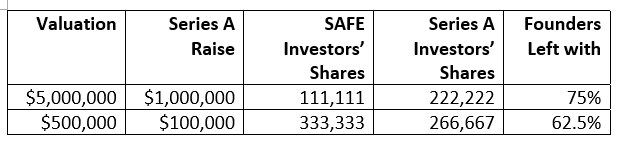

- Founders own 1,000,000 shares (100%)

- SAFE issued for $100k with $1M cap and 20% discount pre-money

Now look what happens depending on the situation at Series A:

We’ve also seen a concerning trend where SAFE notes are being used inappropriately to cover up larger problems, including:

- An inability to find a lead investor and therefore having a party round

- Postponing a priced round due to provide more time to get a “bump up” in valuation because the business can’t justify a priced round at the valuation investors need

- Delaying the need to resolve issues between potential investors and founders by pushing this process to the next round where the stakes will inevitably be higher and the conflict will only grow bigger

At CoinShares Ventures, we see these issues all too often, and in this ebullient market, they’re becoming more and more problematic as too many investors and founders are not running the numbers.

The risk to entrepreneurs is that if the waterfall is too severe, later-stage VCs may be unable or unwilling to invest at all.

Cutting the Knot

So what is the answer?

Just as Alexander the Great pulled out his sword and cut the Gordian knot, I suggest companies solve the problem of building a web on impossibly tangled SAFEs by using an approach that removes these constraints — whenever possible, raise with a priced round.

Although it can be tricky to establish a valuation very early on in a company’s existence, a priced round is always going to look a lot cleaner on the cap table than multiple SAFEs or convertible notes. Even if it might feel like a time-waster from the founders’ perspectives, doing a series of smaller, priced rounds rather than larger slugs of SAFE can also be psychologically appealing especially if each round achieves a little bit higher valuation than the last.

In this heated environment where funds are pushing for marks and companies are raising faster than ever, we worry about the funding gap from Series A to Series B, as crypto capital markets are heavily skewed towards early stage investing and deals are happening at valuations so eye-wateringly high that its difficult to see a path forward.

If you (as a founder) really can’t agree a valuation for a priced round then the best you can do is really, when you do issue a SAFE:

- Try not to have multiple SAFEs with different terms in issue

- Try to keep the Qualifying Equity Funding number as low as possible so that any SAFEs convert fairly quickly (although not too quickly as you’ll want some valuation pick-up so you get as close to the cap as possible!)

- Make sure you know what the cap table is going to look like post-raise under a variety of different conditions so there are no nasty surprises.